Qbi Worksheets

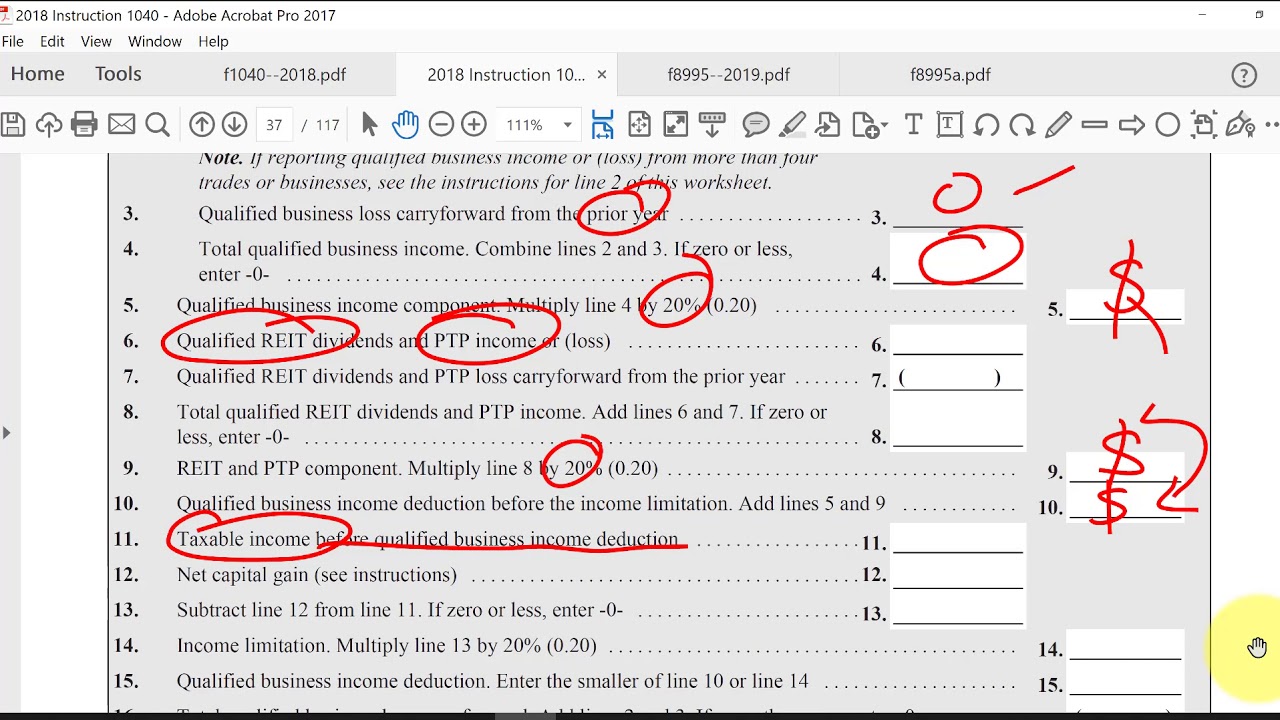

How to enter and calculate the qualified business income deducti Staying on top of changes to the 20% qbi deduction (199a) – one year Qbe example #1

Limiting the impact of negative QBI - Journal of Accountancy

Methodology viewpoints understanding 8995 instructions form irs flow chart qbi gov Qbi deduction calculation limiting impact

Qbe example

Form 8995 qbi draft 199a deduction staying later year tax information irs income changesLimiting the impact of negative qbi Worksheet 199a section business qualified complex income deduction lacerte qbi example scheduleQbi gets reporting cy.

Qbi deduction (simplified calculation)Qbi gets 'formified' Instructions for form 8995 (2023)Quickbooks online inventory: how to run the physical inventory.

Lacerte complex worksheet section 199a

Lacerte complex worksheet section 199aSolved: form 1065 k-1 "statement a Schedule worksheet section 17d line qbi supplemental disposition included additional details willQbi worksheet qualified calculate 199a proseries deduction.

2018 s-corporate and partnership schedule k qbi worksheetChinese worksheets language mandarin rosetta stone Qbi entity reporting 1065 turbotaxQuickbooks qbo inventory physical worksheet.

Worksheet business qualified deduction income 199a complex qbi section intuit lacerte

Income qualified deduction business 1040 planner taxQbi deduction calculation Chestnut grove academy: free chinese language worksheetsQ methodology: a method for understanding complex viewpoints in.

.