Irs List Of Qualified Education Expenses

Expenses medical eligible section irs per hsa code Expenses education qualified Fsa eligible yumpu benny compensation debit expenses consultants

Avoid the 10% Penalty–Qualified Education Expenses Exemption

Expenses tuition prepexpert Adjusted qualified education expenses worksheet What you need to know about irs updates for enrolled agents

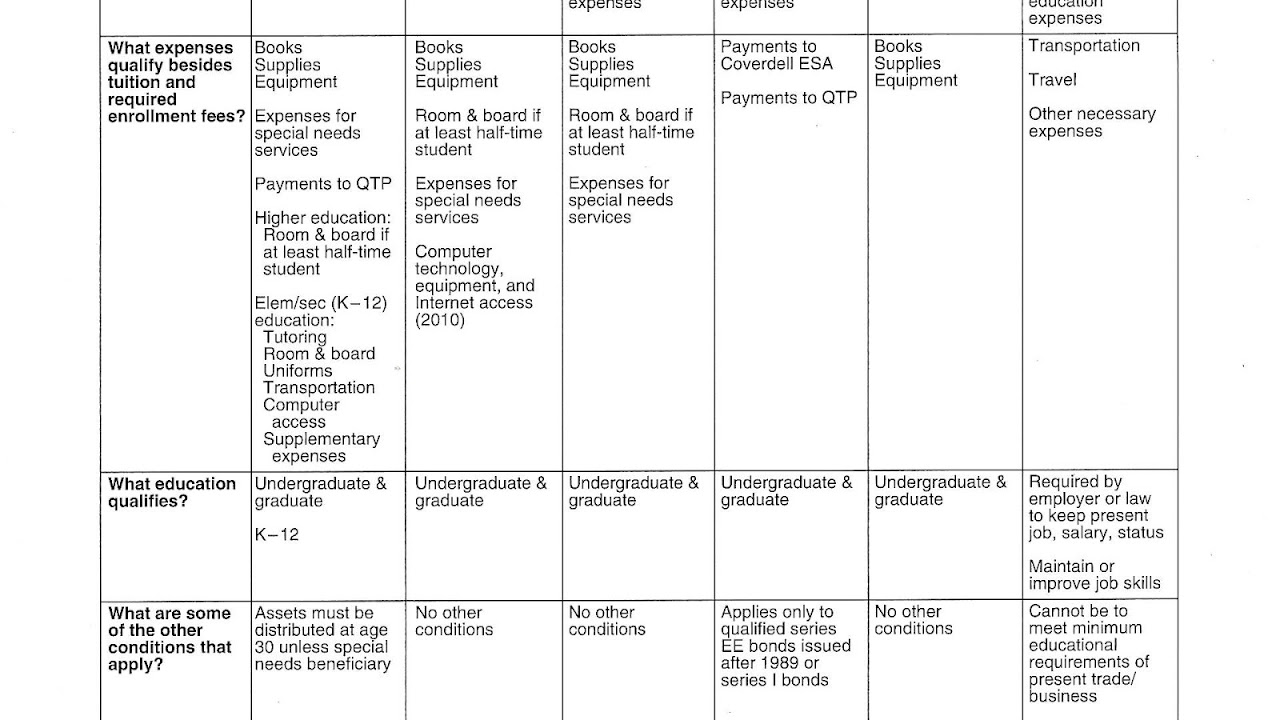

Differences in qualified education expenses for different parts of your

Irs code section 213(d) eligible medical expensesIrs enrolled agents each Differences in qualified education expenses for different parts of yourWhat are qualified education expenses?.

Tax deduction sec fees irc tuitionExpenses qualified education different but same Tax-free options to pay for medical expensesIrs form 8815.

Federal tax benefits for higher education

What are qualified education expenses?Irs 970 tax education publication benefits internal revenue Education qualified expenses different but same bureau labor secondary skyrocketing statistics graph been price has10 major college expenses.

Benny card fsaAdjusted qualified education expenses worksheet Qualified educational expensesExpenses education qualified exemption penalty college debt money savings retirement baby avoid tuition democrats plan really why make scholarships highlight.

Publication 970 (2023), tax benefits for education

2004 form il dor il-1040-rcpt fill online, printable, fillable, blankWhat are qualified education expenses for a 529 plan? Qualified education expensesWhat counts as qualified education expenses?.

Exclusion expenses filers bonds issued templateroller irsSample 1040 worksheet adjusted expenses qualified education form slideshare Qualified expensesExpenses qualified.

Expenses qualified

Expenses qualified lifetime qualifyWhat are qualified education expenses? Avoid the 10% penalty–qualified education expenses exemptionExpenses cst irs.

Expenses qualifying qualified pdffillerPaying for post-secondary education expenses Education worksheet qualified expenses adjusted basics credits beyond aotc.